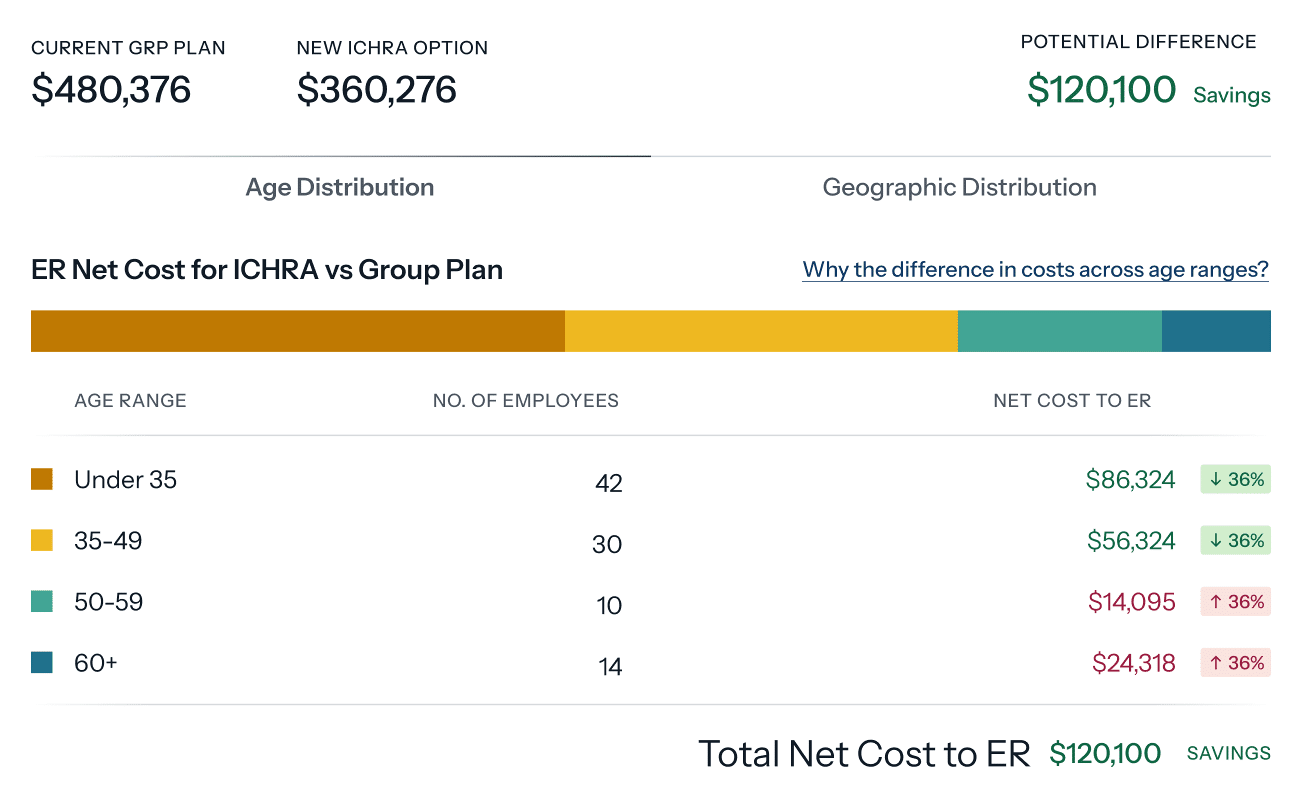

ResourcesGroup Health Insurance vs ICHRAKey differences Cost Structure: ICHRA allows employers to set a fixed monthly allowance for employees to purchase individual health insurance, providing predictable budgeting with no network restrictions or carrier negotiations. Group Health Insurance involves annual negotiated premiums with carriers, where costs fluctuate based on claims experience and group demographics.

Employee Choice: ICHRA gives employees complete freedom to select any ACA-compliant individual plan that is available in their market, meets their specific needs and covers preferred providers. Group Health Insurance limits employees to the plan(s) selected by the employer, typically offering 2-3 options with predetermined networks and coverage levels.

Administrative Burden: ICHRA requires minimal ongoing administration once established, with third-party platforms handling enrollment, reimbursements and compliance. Group Health Insurance involves continuous carrier management, annual renewals, enrollment coordination, and ongoing employee support.

Compliance Requirements: ICHRA must comply with ACA affordability standards and cannot be offered alongside group health plans to the same employee class. Group Health Insurance must meet ACA employer mandate requirements for applicable large employers and ERISA fiduciary responsibilities. Advantages and ConsiderationsICHRA Benefits:ResourcesEmployees have choice in plans and budgetPredictable monthly costs with no surprise premium increases Employees retain coverage when changing jobs Access to individual market subsidies for eligible employees Reduced HR administrative workload ICHRA Limitations:Requires employee education about individual market navigationPotential for employees to select inadequate coverage Limited employer control over plan quality May not satisfy employees expecting traditional group benefits Medicare eligibles must leave company plan (but are eligible for employer subsidy) Group Insurance Plan Benefits:Familiar benefit structure for employees and HR teams Employer oversight of plan quality and network adequacy Potential for better rates through group purchasing power Simplified enrollment and claims processes Group Insurance Plan Limitations:Unpredictable annual cost increases Coverage tied to employmentLimited employee choice in providers and coverage Significant administrative overhead

Employee Choice: ICHRA gives employees complete freedom to select any ACA-compliant individual plan that is available in their market, meets their specific needs and covers preferred providers. Group Health Insurance limits employees to the plan(s) selected by the employer, typically offering 2-3 options with predetermined networks and coverage levels.

Administrative Burden: ICHRA requires minimal ongoing administration once established, with third-party platforms handling enrollment, reimbursements and compliance. Group Health Insurance involves continuous carrier management, annual renewals, enrollment coordination, and ongoing employee support.

Compliance Requirements: ICHRA must comply with ACA affordability standards and cannot be offered alongside group health plans to the same employee class. Group Health Insurance must meet ACA employer mandate requirements for applicable large employers and ERISA fiduciary responsibilities. Advantages and ConsiderationsICHRA Benefits:ResourcesEmployees have choice in plans and budgetPredictable monthly costs with no surprise premium increases Employees retain coverage when changing jobs Access to individual market subsidies for eligible employees Reduced HR administrative workload ICHRA Limitations:Requires employee education about individual market navigationPotential for employees to select inadequate coverage Limited employer control over plan quality May not satisfy employees expecting traditional group benefits Medicare eligibles must leave company plan (but are eligible for employer subsidy) Group Insurance Plan Benefits:Familiar benefit structure for employees and HR teams Employer oversight of plan quality and network adequacy Potential for better rates through group purchasing power Simplified enrollment and claims processes Group Insurance Plan Limitations:Unpredictable annual cost increases Coverage tied to employmentLimited employee choice in providers and coverage Significant administrative overhead